When you sell a capital property, you usually receive full payment at that time. However, sometimes you receive the amount over a number of years. For example, you sell a capital property for $50,000 and receive $10,000 when you sell it and the remaining $40,000 over the next four years. If this happens, you may be able to claim a reserve.. If your total federal political contributions from line 40900 of your return were $1,275 or more, enter $650 on line 41000 of your return. If not, use the amount from line 40900 to calculate your federal political contribution tax credit using the chart for line 41000 on your Federal Worksheet. Enter the result on line 41000 of your return.

The European Court finds once again that Bulgaria has breached the right to vote of persons with

Pillar 2 elections explained election to spread capital gains

10 Tax Elections to Save Money on Your 2019 Return Hantzmon Wiebel CPA and Advisory Services

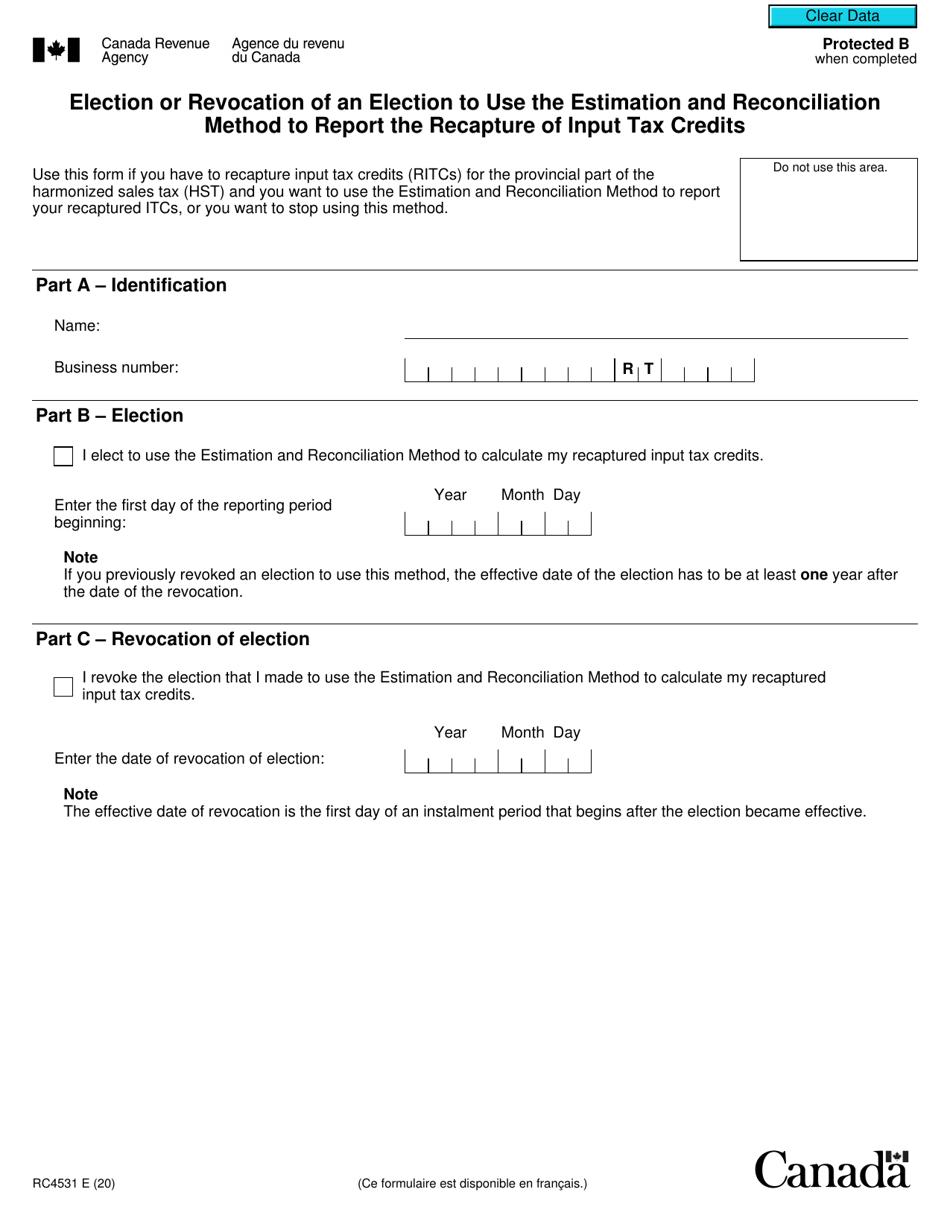

Form RC4531 Download Fillable PDF or Fill Online Election or Revocation of an Election to Use

Federal implications of passthrough entity tax elections

Understanding the SALT Deduction and PTE Tax Elections GYF

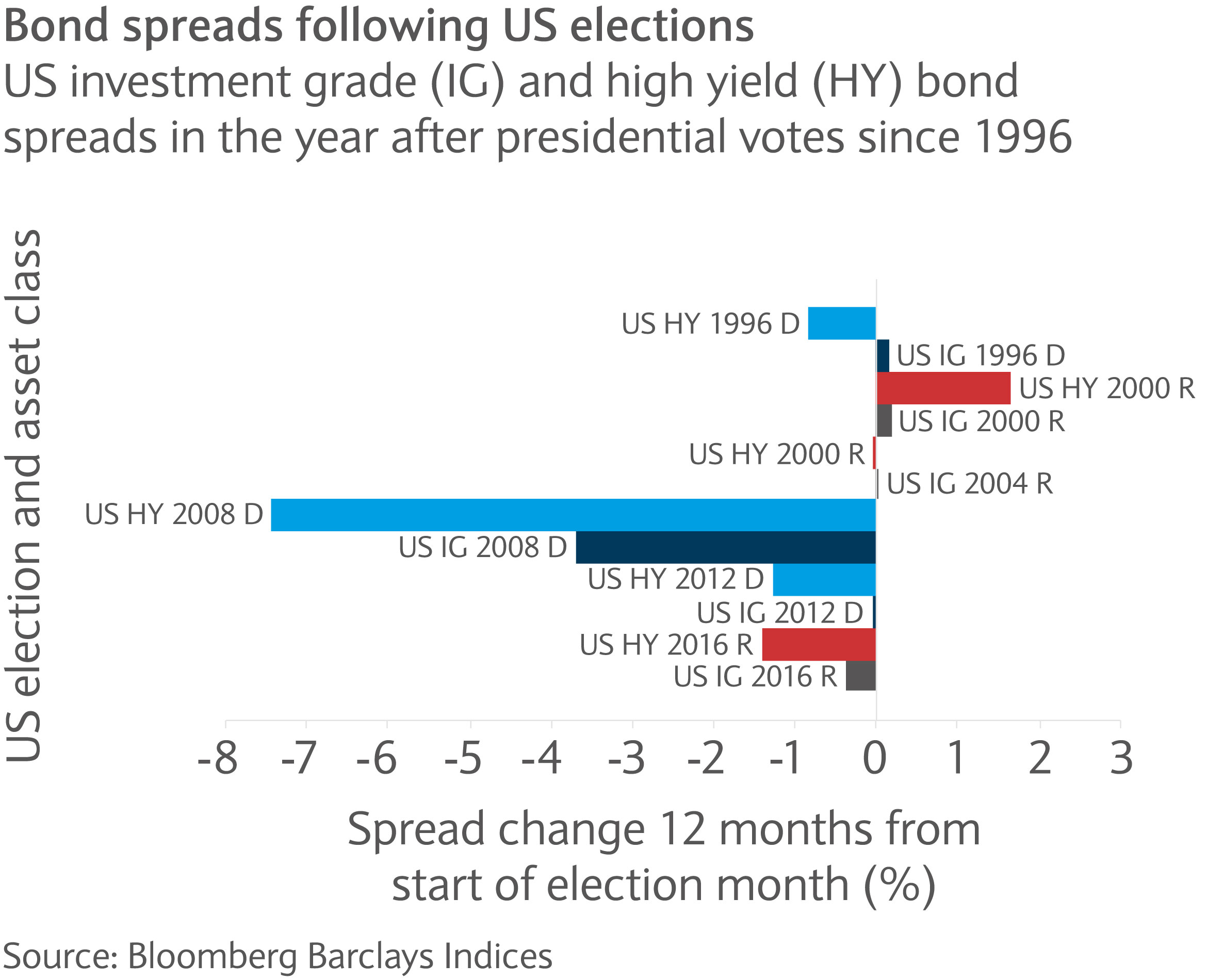

Election results rarely impact bonds Barclays Private Bank

Election Party Must Haves

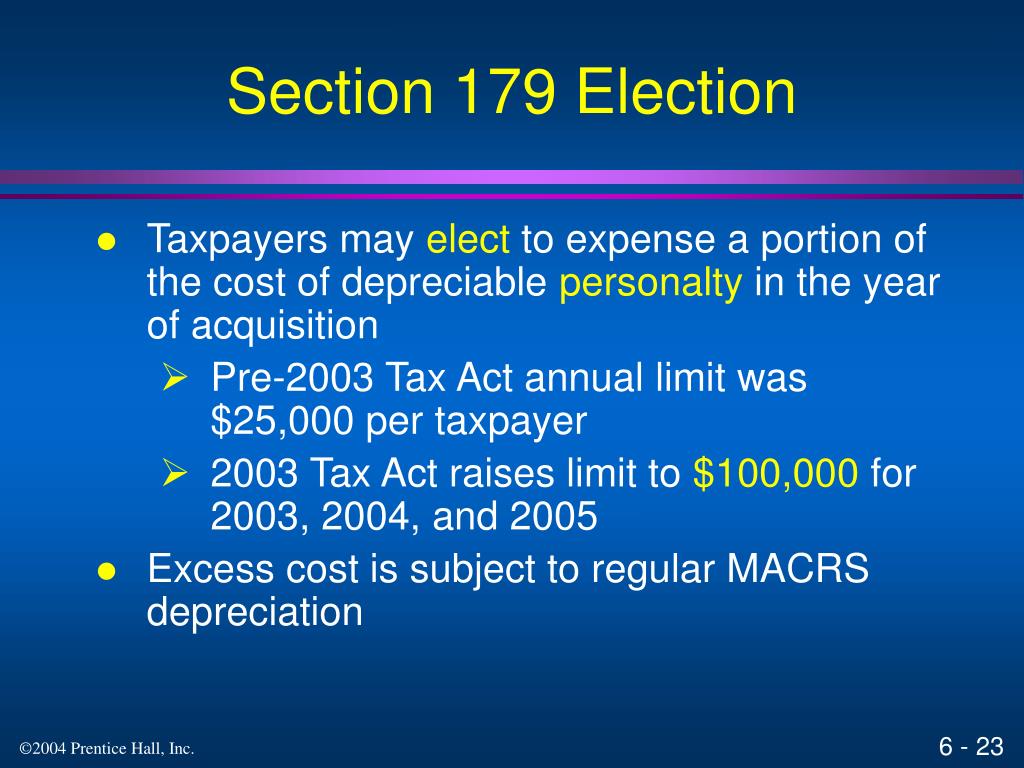

PPT Property Acquisitions and Cost Recovery Deductions PowerPoint Presentation ID5773077

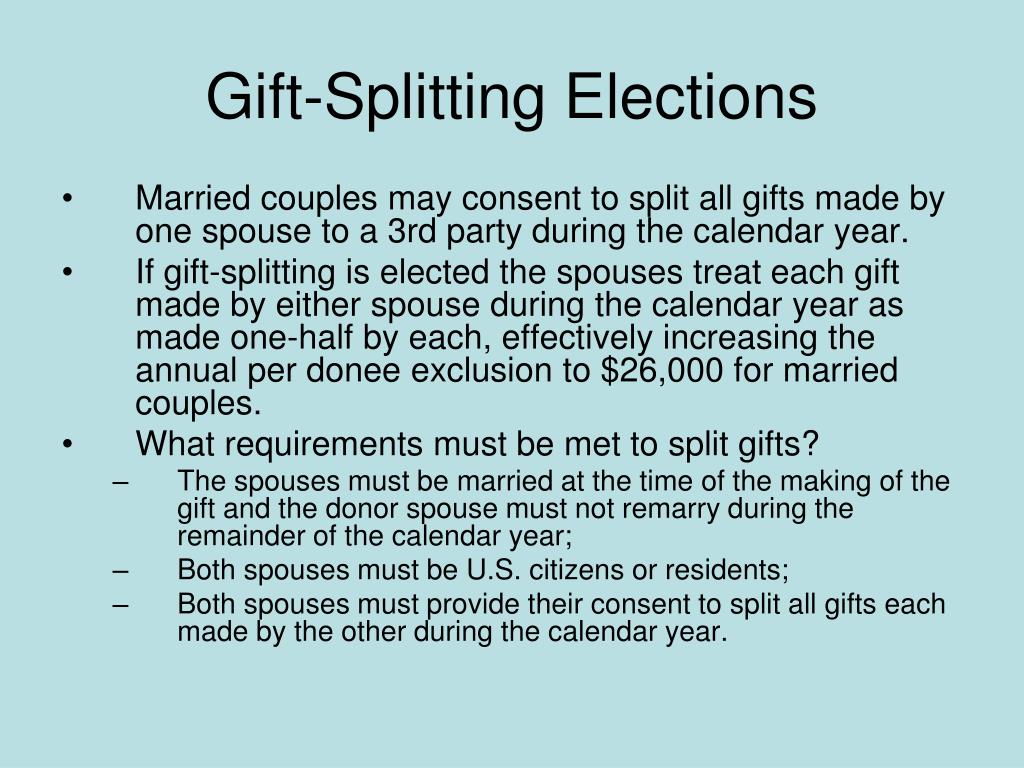

PPT COMMON MISTAKES IN THE FILING OF GIFT TAX RETURNS AND HOW TO AVOID THEM, WITH SAMPLE FORM

4 Deductions From The Election YouTube

Pillar 2 Elections Explained Election to Spread Capital Gains TaxModel

5 Voting Gifts for the Holidays Election Connection

8 best gifts to give for an investment education WTOP News

PPT COMMON MISTAKES IN THE FILING OF GIFT TAX RETURNS AND HOW TO AVOID THEM, WITH SAMPLE FORM

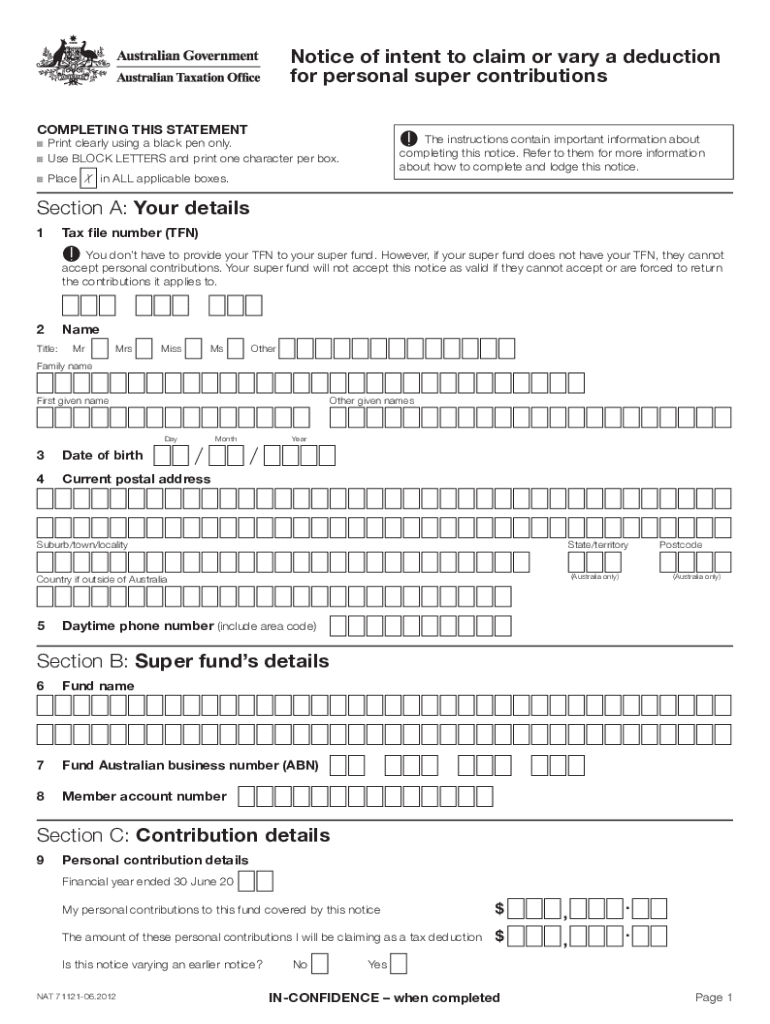

Deduction For Personal Super Contributions Australian Taxation Office Ato Gov 20202022

Electoral Trust and its Exemption and Deduction under Tax Act 1961

PPT Chapter 13 Gift and Estate Planning The Basics PowerPoint Presentation ID1022951

PreElection Gift is this a heartache for first home buyers? Vision Aggregation

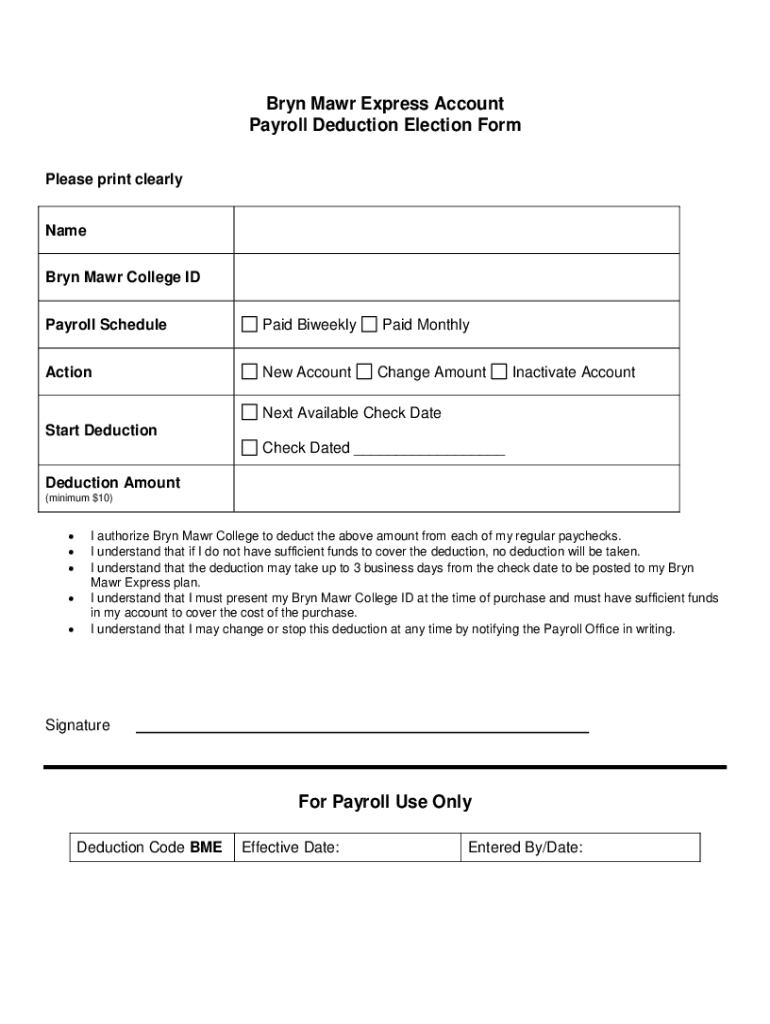

Fillable Online Bryn Mawr College Payroll Deduction Gift Election Form Fax Email Print pdfFiller

Eligible amount of the gift - This is the amount by which the fair market value (FMV) of the gifted property exceeds the amount of an advantage (see definition above), if any, in respect of the gift. There are situations in which the eligible amount may be deemed to be nil.. You can do this if the gift would be allowed as a deduction under.. A "split-gift" election allows married couples to maximize their combined use of available gift tax exclusions. Under a split-gift election, a gift made to a third party is treated as being made one-half by each spouse, even if the gift was actually made from only one spouse's assets. (Int.Rev. Code § 2513(a).)